Annual benefit limit

HK$25,000,000Area of cover

Asia, Australia and New ZealandPremiums as low as

HK$256/monthAnnual benefit limit

HK$35,000,000Area of cover

Asia, Australia and New ZealandPremiums as low as

HK$317/monthAnnual benefit limit

HK$30,000,000Area of cover

Worldwide excluding the United StatesPremiums as low as

HK$288/monthAnnual benefit limit

HK$40,000,000Area of cover

Worldwide excluding the United StatesPremiums as low as

HK$352/monthIf you're diagnosed with a critical illness, you may need to take time off work or even quit your job. This combined with the costs of treatment may affect your budget, your quality of life and even your family. Therefore, apart from medical protection, you should also consider adding the Supplementary Critical Illness Benefit to make up for any lost income and pay for your living expenses, such as mortgage, daily bills, child's tuition fees, etc. if you have a covered critical illness.

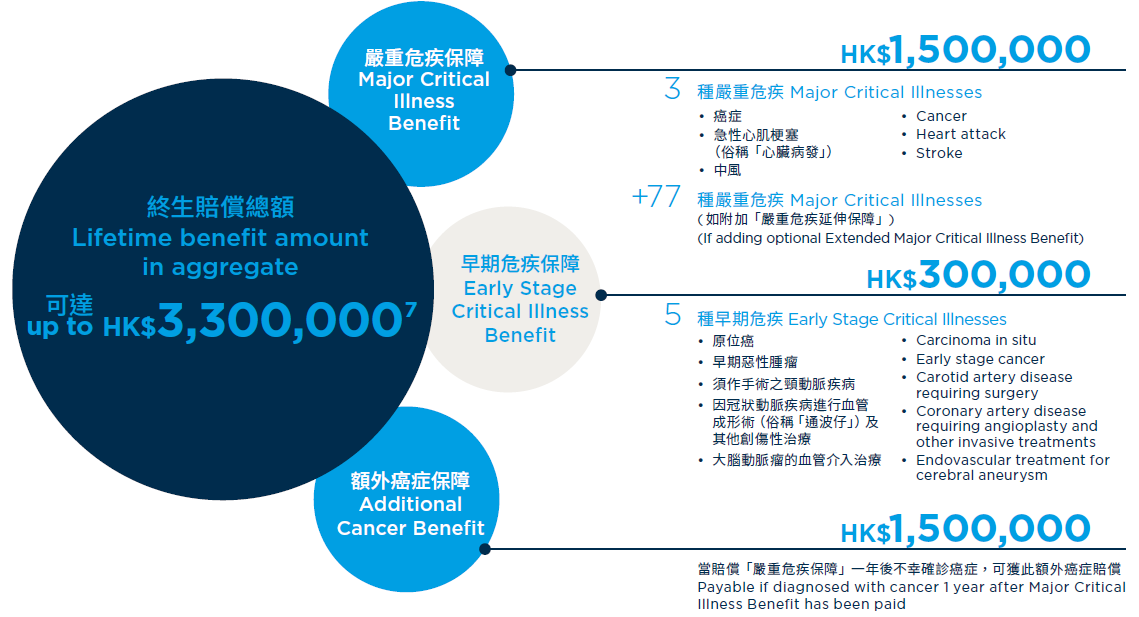

Bupa Supplementary Critical Illness Benefit provides worldwide coverage for up to 98% of all serious critical illnesses (see Remark 19), including 80 major critical illnesses (such as cancer, heart attack, stroke) and 5 early stage critical illnesses (see Remark 20). It also pays for an additional cancer claim if you're diagnosed with cancer (including recurrence or distant metastasis) after the major critical illness has been paid, so you can be worry-free and prepared for the unexpected. This benefit offers triple protection for up to 3 separate conditions at different times throughout your life—Major Critical Illness Benefit, Early Stage Critical Illness Benefit and Additional Cancer Benefit, with a lifetime benefit amount up to HK$3,300,000 in aggregate (see Remark 21).

Based on the benefits of the Gold plan. Please refer to the Schedule of Critical Illness Benefits for the lifetime benefit amount of other plan options.

We know that patients who are diagnosed with cancer can be overwhelmed by ongoing treatments, complicated medical procedures and so on. The new Cancer Care Programme in our Health Coaching Services is designed to support members covered by Supplementary Critical Illness Benefit. Our qualified nurses and health management professionals will provide personalised follow-up throughout your cancer journey, emotional support and a variety of health information such as cancer care and dietary tips.

Our health coaching services offer a variety of personal healthcare support delivered by a team of appointed doctors, qualified nurses and health management professionals to minimise your worries (see Remark 13):

A team of qualified health management professionals will provide guidance on your health-related questions over the phone, with the support of doctors (see Remark 14).

Our Care Manager can be in touch with you to follow up on claims and assist you throughout treatment and recovery, from explaining your treatment plan and overseeing costs to arranging follow-up consultations. If you’re admitted to a local private hospital, our Care Manager will make a courtesy call or visit, with your consent.

We'll arrange for you to get medical advice from a panel of medical specialists to clarify your doubts and make informed decisions about treatment.

We can provide a list of clinics and hospitals based on your specific condition or needs for your reference.

Offers lifestyle coaching and management, including personal phone calls to help you manage any chronic condition such as diabetes.

Locate suitable doctors, arrange medical appointments and support language translation either when you are in need overseas, or plan to travel for treatment.

We can help to make appointments with your selected healthcare service providers.

Cancer Care provides comprehensive support to help you navigate the complexities of cancer care. This includes a dedicated nurse hotline, personalised treatment plans, and fast-tracked booking services.

You can use your Bupa Hero card (BH card) to enjoy cashless service for confinement at designated private hospitals in Hong Kong or for day case procedures, prescribed non-surgical cancer treatment or prescribed diagnostic imaging tests at a Bupa Hero appointed service provider.

Please submit a pre-authorisation form to Bupa at least 2 working days before treatment and present your BH card and/or pre-authorisation

confirmation at registration. For details of obtaining pre-authorisation, please refer to the Membership Guide.

Bupa will settle your eligible medical expenses with the hospital or service provider directly, subject to the approved credit limit stated in your pre-authorisation confirmation / guarantee of payment letter. You’ll need to pay any medical expenses exceeding the credit limit and submit a claim to Bupa for reimbursement. If you’ve chosen a deductible, or your medical expenses exceed the maximum limit or aren’t covered, you’ll also need to reimburse Bupa for the selected deductible and shortfall.

For the list of designated private hospitals in Hong Kong, please visit www.bupa.com.hk/hero. For overseas hospitalisation, you can enjoy cashless service in your chosen area of cover by calling Bupa to make the necessary arrangements. The latest list of Bupa Hero appointed service providers can be found on Bupa’s customer service portal myBupa. These lists are subject to change from time to time. If you’re unable to get pre-authorisation due to an emergency, please arrange subsequent pre-authorisation on the next working day.

For new application or renewal from 1 April 2023

From

HK$256/month